In recent months, we have discussed both the basics of the Medicare Access and CHIP Reauthorization Act (MACRA) and the . MACRA changes how Medicare pays for physician services, repeals the Medicare physician sustainable growth rate (SGR) formula and instead provides predictable payment increases. MIPS is one of the two-path Quality Payment Program (QPP).

In recent months, we have discussed both the basics of the Medicare Access and CHIP Reauthorization Act (MACRA) and the . MACRA changes how Medicare pays for physician services, repeals the Medicare physician sustainable growth rate (SGR) formula and instead provides predictable payment increases. MIPS is one of the two-path Quality Payment Program (QPP).

This month, we’ll close out our discussion of this program by explaining the fundamentals of Alternative Payment Models and Protecting Access to Medicare Act (PAMA). Combined, the three parts of our Making Sense of MACRA series should allow you to understand the nitty-gritty of what many may call, yet another government-induced headache!

What are APMs, anyway?

Association of Professors of Medicine? Alternative Pest Management? Not for this discussion! When referencing MACRA, APMs stands for Alternative Payment Models.

This payment approach for Medicare beneficiaries gives added incentive payments to provide high-quality and cost-efficient care. APMs can apply to a specific clinical condition, a care episode, or a population. APMs are the second of the two-path Quality Payment Program (QPP).

APMs and MIPS are not exclusive tracks. If a provider is in a specific type of APM called a MIPS APM and they are not excluded from MIPS, they may be scored using a special APM scoring standard. The APM scoring standard is designed to account for activities already required by the APM.

There are also Advanced APMs, a subclass of APMs that have additional requirements and give providers a 5% incentive for achieving threshold levels of payments or patients. If a provider achieves these thresholds, they are excluded from the MIPS reporting requirements and payment adjustment. You can see which models are considered Advanced APMs for 2018 here (scroll down to “What models are Advanced APMs?”).

Center for Medicare and Medicaid Services (CMS) allows providers to check their QPP participation status here, which includes both APM and MIPS participation. Click here to learn how CMS identifies eligible clinicians who, through their participation in APMs, are Qualifying APM Participants (QPs) for a year. These clinicians will be eligible to receive the 5% APM Incentive Payment.

Protecting Access to Medicare Act

The Protecting Access to Medicare Act (PAMA) of 2014 is, as you may have guessed, is another government regulatory measure and was signed into law on April 1, 2014. It establishes a market-based pricing system for lab tests in an effort to bring Medicare payments into closer alignment with private payer rates. As ADVANCE Healthcare explains, the goal of PAMA is to collect data around clinical diagnostic laboratory tests (CDLTs) and advanced diagnostic laboratory tests (ADLTs) to determine what level of payments will be provided for these tests.

Out With the Old, In With the New

Medicare previously paid for CDLTs under the Clinical Laboratory Fee Schedule (CLFS). First adopted in 1984, CLFS rates were only updated to establish payment for new tests or to make statutory, across-the-board updates. There were 57 local fee schedules and the same pricing schedule for all categories of testing.

Under PAMA, payment rates for existing tests are based on current private payer rates and updated every three years using current data. There is a single national fee schedule and a new category of lab tests called Advanced Diagnostic Laboratory Tests (ADLTs) with a different pricing schedule. The new fee schedule was implemented January 1, 2018.

The Industry is Concerned (and Pushes Back)

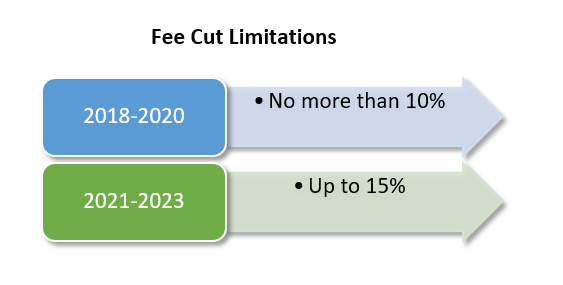

Many in the industry are opposed to the change, concerned that the law will result in drastic cuts in reimbursements. The American Clinical Laboratory Association filed a lawsuit challenging the process by which CMS set prices for laboratory tests. CMS has stated that only 5% of clinical laboratories are subject to PAMA reporting requirements and most hospital laboratory work is excluded, as are laboratories earning less than $12,500 in Medicare reimbursements annually.

Concerns still linger. The Baltimore Sun reported last year that research indicates that a 10% cut to the top 25 tests, under PAMA, could produce a $400 million fee cut in 2018. Additional fee reductions could increase these reductions to $1.2 billion by 2020. Furthermore, excluding smaller laboratories and hospitals from the data pool could allow larger laboratory chains to benefit, to the detriment of smaller laboratories.

Go To the Source

The best place you can learn more about MACRA and PAMA is directly from the source. We can’t guarantee it won’t be as painful as standing in line at the DMV, but the information will be accurate! Visit CMS’ MACRA site here and learn more about PAMA regulations here.

Learn more about how our Strep, Flu, PSA and iFOB Tests can help you meet specific quality measures

Share Article